Food tax calculator

Visit the Office of the Under Secretary of Defense to find Basic Allowance for Subsistence BAS. Our calculations assume that the employee.

How To Calculate Sales Tax In Excel Tutorial Youtube

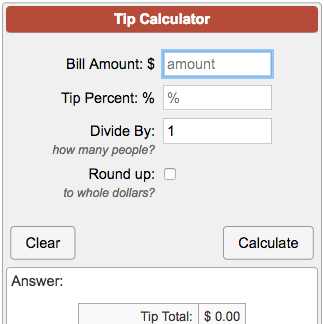

If you receive tips in your paycheck this calculator will help you estimate the withholdings every pay period.

. 13 HST point of sale rebate of 8 on prepared meals 400 and under Alcoholic beverages. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The calculator will show you the total sales tax amount as well as the county city.

13 HST 8 point of sale rebate. Afford the city you want to live in. In the US a tip of 15 of the before tax.

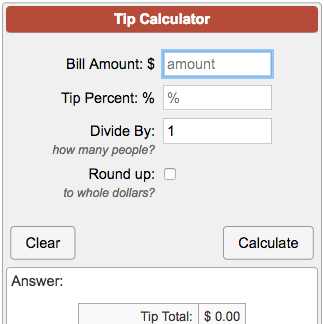

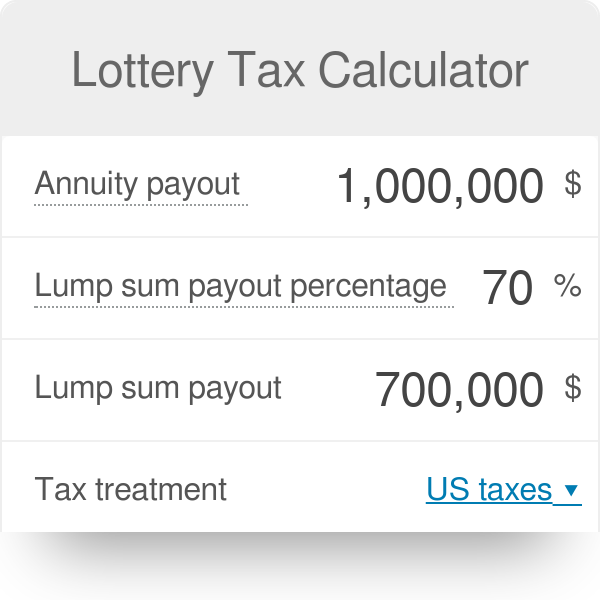

If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. The Tip Calculator calculates tip amount for various percentages of the cost of the service and also provides a total amount that includes the tip. The default setting is 70 with the allowable range of 50-100.

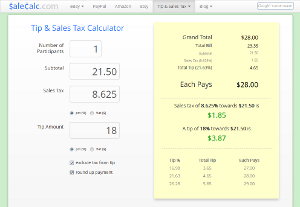

Tip Sales Tax Calculator Number of Participants Subtotal Sales Tax pct flat Tip Amount pct flat exclude tax from tip round up payment Grand Total Total Bill Subtotal. BAH Calculator Updated. Then use this number in the.

Your household income location filing status and number of personal. Free Easy to Use Food Cost Calculator for Excel. Food Tax Food Tax Sales Tax Rate for Food and Personal Hygiene Products Sales of food for home consumption and certain essential personal hygiene products are taxed at the reduced.

Get free guidance on changes you can make to afford more. Cost of living refers to what it takes to afford lifes necessities like food utilities shelter and transportationor what we call the Four Walls. New York Manhattan Comparable Income.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. May not be combined with other. Before you get dead set on moving to a new.

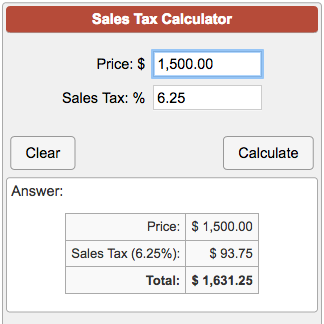

Multiply the price of your item or service by the tax rate. The tax is 625 of the sales price of the meal. Your household income location filing status and number of personal exemptions.

It also helps you keep track of. For example here is how much you would. This free food cost calculator works out food cost per dish and helps you calculate food cost percentage.

Paycheck Tip Tax Calculator. You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code. The default setting is 150 centsoz with the allowable range of tax rates from 10.

How to use BIR Tax. The Tax Caculator Philipines 2022 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation. Tax per ounce rate.

Ontario Tax Brackets For 2022 Savvynewcanadians

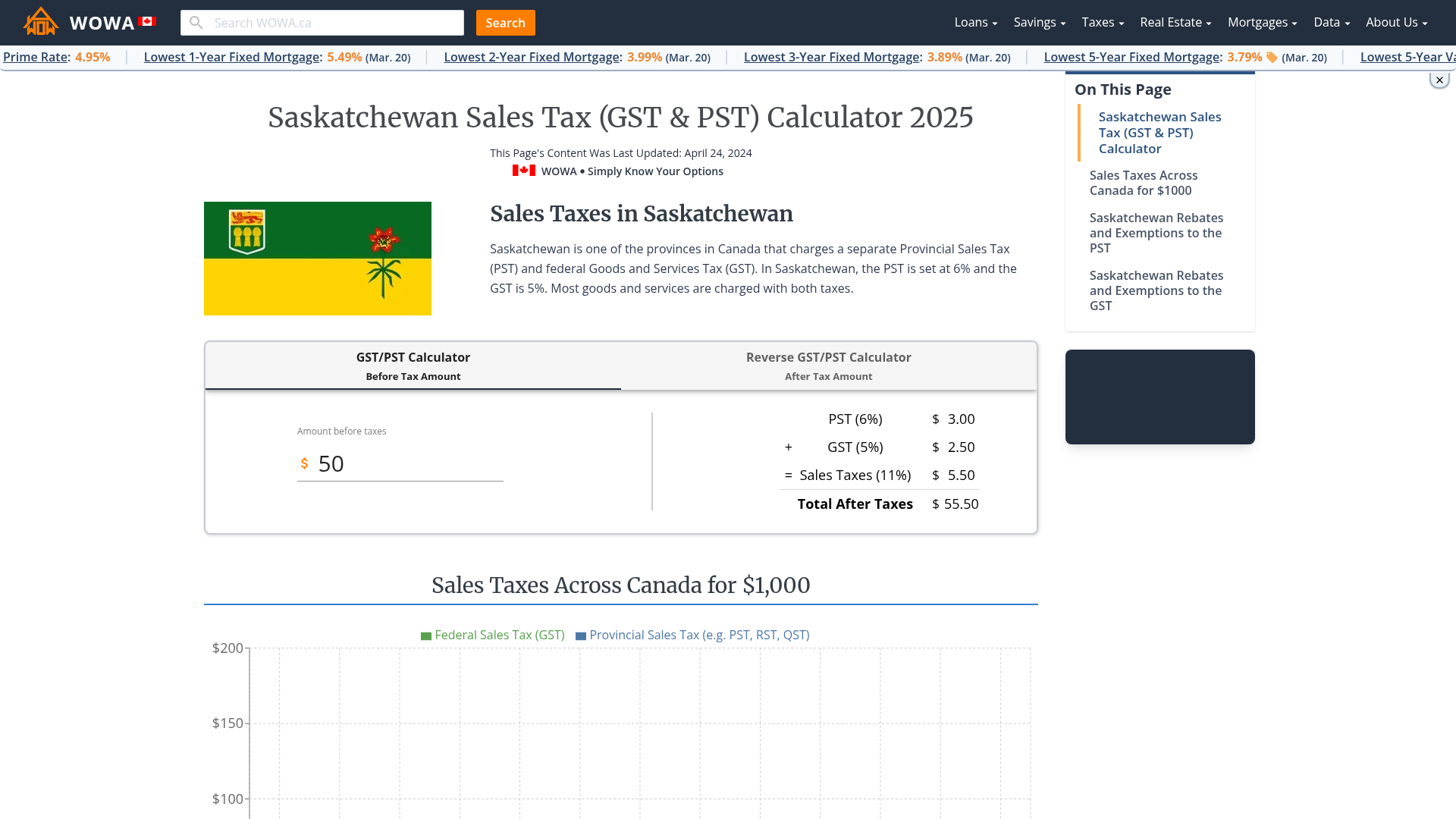

Saskatchewan Sales Tax Gst Pst Calculator 2022 Wowa Ca

Casio How To Use Calculator Tax Calculations Youtube

Tip Sales Tax Calculator Salecalc Com

Vat Calculator

Lottery Tax Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Tip Calculator

Sales Tax Calculator

Sales Tax Calculator

Yqme50hpmtgn8m

How To Calculate California Sales Tax 11 Steps With Pictures

Sales Tax Calculator

Gst Calculator Goods And Services Tax Calculation

Sales Tax Calculator Taxjar

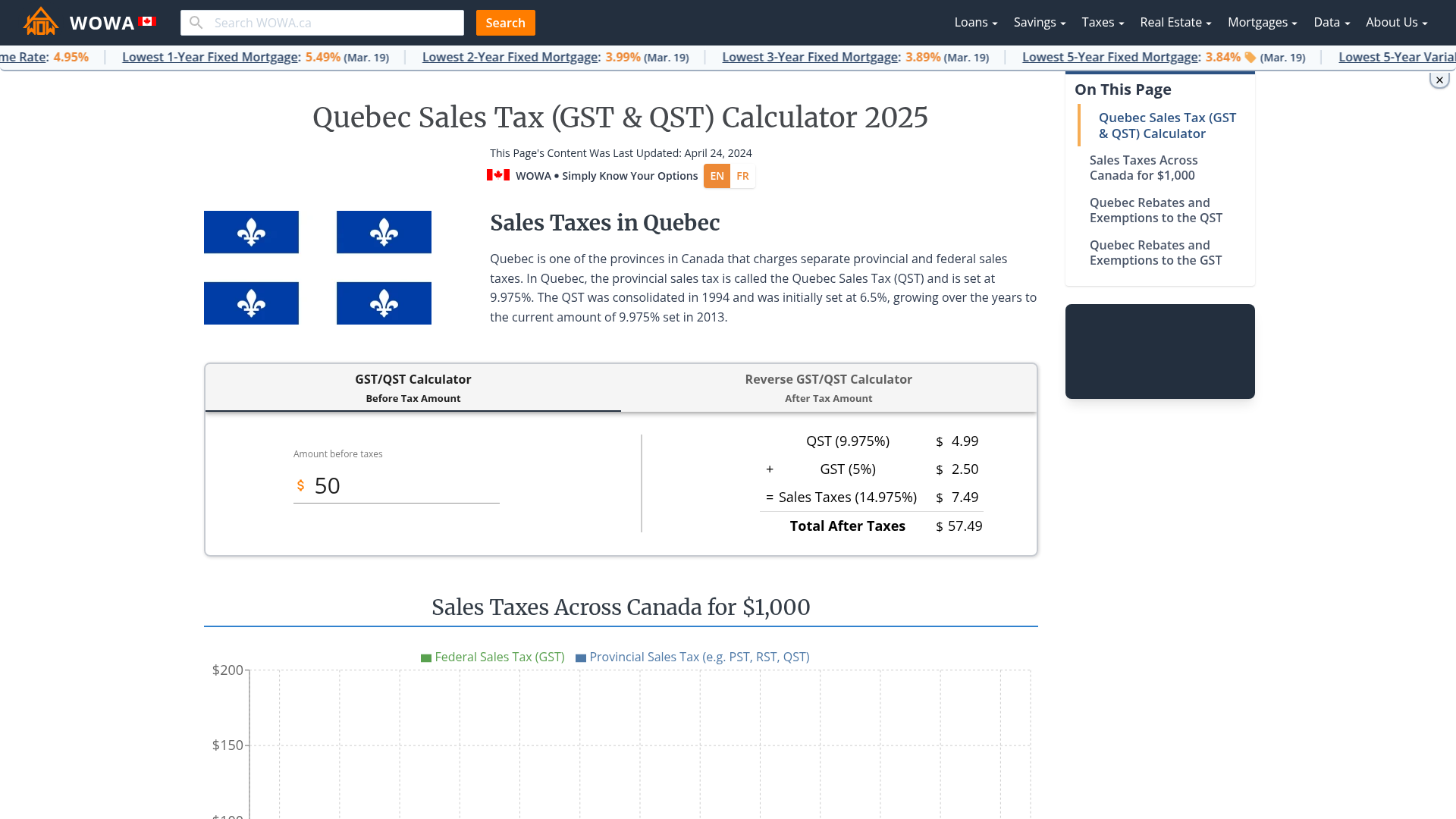

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022